The Rise of App Stores for Commercial Software

App stores for mobile devices are ubiquitous. Few people think of heading to a software company’s website to download an app. They head for their mobile platform’s app store and they certainly don’t think of calling up a sales department to make an app purchase.

The commoditization and disposability of apps is a significant part of the success of app stores. If you download an app, you’ll typically decide in just a few minutes as to whether to leave it on your device or uninstall it. While we tend to take more than just a few minutes to do an evaluation of enterprise software systems, we are headed in the same direction as mobile apps in several key ways, as technologies and standards arise to enable new forms of commerce.

How We Buy Enterprise Software Today

If you are reading this, odds are you’ve been exposed to an enterprise software sales process in some way, either from the customer or vendor side. This can often be a long and drawn-out process complicated by long procurement cycles, optional functionality, one-off pricing, and exorbitant prices for professional services providing integration and customization.

Sometimes, the purchases are small enough that the vendor offers only “off the shelf” pricing and integrations. On the other hand, large scale and complex enterprise software systems will often include professional services costs that can eclipse the price of the software licensing itself. In these sales models it’s not uncommon for sales representatives to sell the promise of functionality that doesn’t yet exist or give price breaks on the core software while inflating professional services. Further, commissions can account for sizable portions of a given deal and this eats into the overall return on sales.

For several reasons, this is changing. Customers are increasingly showing a preference for app store models when buying even the most expensive enterprise software systems. As younger people, used to immediate results, rise in rank and buying power within companies, they are interested in what works today. They want immediate tangible benefit and ROI, not the promise of future return on an enterprise software purchase that will take months to get in place.

Businesses are increasingly preferring out-of-the-box working solutions over the promise of software that can only be delivered with professional services. These old practices of selling software will soon be tolerable to only the biggest of bureaucracies.

But as anyone with a technical background will tell you, creating software that is sellable in this way is more complex than adding a mobile application to a mobile store.

Software as a Service

SaaS (Software as a Service) is about far more than a solution’s licensing model. On the backend SaaS is an overloaded term because there so many ways to deliver SaaS solutions. SaaS solutions can be desktop clients sold on a per-seat basis, like Microsoft Office 365 or Adobe’s Creative Cloud. Increasingly, today’s classic SaaS model is web-based software that runs in the cloud in a multi-tenant platform, serving up functionality to many customers using the same backend or platform instance.

SaaS has not only changed expectations around pricing and software licensing models, but it has changed expectations around sales cycles, too. While there is still evolution and maturity occurring here, SaaS has redefined the way software is created, sold, and consumed. This is furthering the commoditization of large-scale solutions.

The Continuing Evolution of Commercial Software Marketplaces

Although purchasing a SaaS solution is still not typically as simple as purchasing a game from a mobile app store, things are headed in this direction. General purpose and industry-specific marketplaces are springing up everywhere these days. Large enterprise systems like Salesforce were the first to offer such marketplaces, offering 1st and 3rd party extensions to the core platforms.

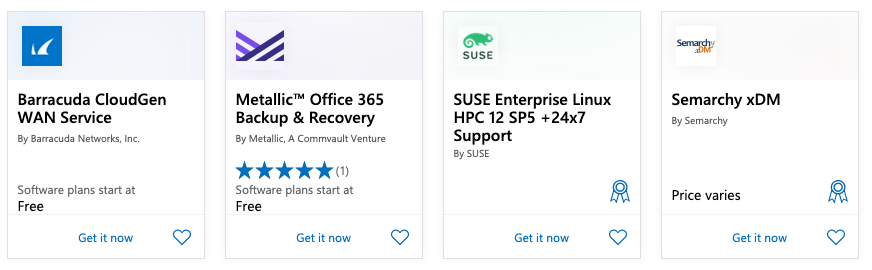

Big cloud vendors were next to the marketplace game and are currently where the big bets lie. Searching through Microsoft’s Azure Marketplace one can find many competing EMRs (Electronic Medical Record systems), demonstrating that even the most regulated of industries can find solutions in SaaS models delivered through application marketplaces.

Now we are seeing a proliferation of smaller, boutique app stores built along industry verticals. Insurance, financial services, and healthcare are just some examples where companies are blending the big cloud player model with the industry-vertical model, offering “best in breed” solutions for their respective platforms and markets.

Integrations Are Getting Easier

But what about professional services so often tacked on to large enterprise software deals? It turns out that system integration is getting easier and doing so rapidly. When evaluating that new EMR system, buyers can increasingly rely on system integration add-ins to large enterprise systems. For example, while an in-use EMR may contain petabytes or more of data, porting that data to a new EMR vendor is decreasing in time and cost.

In the case of healthcare, this is becoming possible due to a common industry accepted integration protocol called FHIR, or Fast Healthcare Interoperability Resources specification, which is a standard for exchanging healthcare information electronically. Vendors adopting common industry standards like FHIR are adding value to their customers by allowing for quicker and less complex “low-code” migrations, while at the same time opening themselves up to easier migration from one enterprise system to another.

Some third-party software vendors even create specialized migration software available as add-ins to the platforms. This is an increasingly easy thing to do when software systems adhere to common standards. For example, a systems migration vendor could take advantage of Microsoft Azure’s API for FHIR to create a migration product if the respective systems implement the common industry standard.

Customers are pressuring product companies to implement industry standard data exchange protocols for quicker and easier integration with existing system. The adherence to data exchange standards also makes it easier to build 3rd party data integration products and to migrate major systems from one vendor to another.

The Attraction of Commercial Software Marketplaces

Commercial software marketplaces are creeping up on the traditional sales models and will soon be eating them for dinner. Customers want solutions that work today, not expensive projects that promise future returns.

Software marketplaces can deliver this along with easy to administer “try before you buy” models. Even some of the bigger software solutions offer 30-day trials, providing full features to take for a test drive. This allows quick evaluation for faster comparison of competing products. If a solution doesn’t demonstrate value quickly and easily customers can cancel their trial or subscription, not unlike uninstalling a mobile app after a cursory exploration.

Although most marketplaces offer features like custom pricing and one-off license models for sellers, these features will fall in demand as buyers increasingly prefer the “no dicker sticker” pricing model. This makes the transaction, and the buyer’s experience, simpler.

A common model for success in commercial marketplaces is to offer a base platform with some functionality, but also offer first-party add-ons for additional licensing costs. Just buy the add-on to upgrade your installation. In fact, third-party add-ons to popular platforms are nothing new. Salesforce’s appexchange is one such marketplace stocked full of third-party add-ons, just as one can extend the functionality Microsoft SaaS products through the AppSource marketplace. This commercial software marketplace offers 1st and 3rd party add-ons and upgrades to Dynamics 365, Microsoft’s Power Platform, and Microsoft 365 products.

This model of growing core capabilities through add-on purchases is especially attractive to smaller organizations who may not need a full-blown integrated CRM today, but may want to add additional capabilities as the need arises.

Here to Stay

Commercial Software marketplaces aren’t going away anytime soon. In fact, further investment by marketplace providers and is projected in the next several years. Both general and industry-specific marketplaces are getting increasing attention from customers and by those who host them.

The good news is that this opens a new channel for companies looking to buy software. Not only are they often able to try before they buy but are able to easily compare products before making a purchase. Customers buying into large platforms can grow their investment at their own pace and the system’s capabilities through additional functionality that can be licensed in a few clicks through a commercial software marketplace.

Recent Comments